Case studies: Outcome-based pricing in action

Let’s examine some real-world examples of companies successfully implementing outcome-based pricing models.

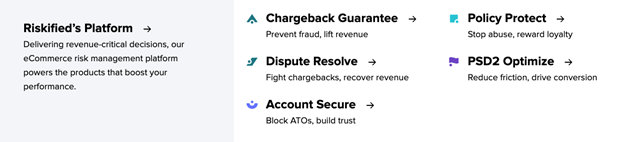

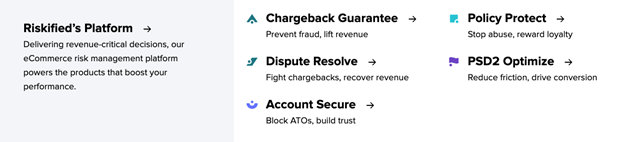

Riskified, an ecommerce fraud prevention provider, uses advanced algorithms to assess transaction risks in real time, providing instant approve/decline decisions. Riskified guarantees approved transactions against fraud and charges only for successfully approved, fraud-free transactions. This model incentivizes Riskified to continually improve its algorithms and deliver value, as the company only profits when its solution effectively prevents fraud and increases sales.

Riskified’s Chargeback Guarantee is prominently featured on its website

Source: Riskified

Riskified’s approach is particularly effective because it directly reduces client expenses. This makes outcome-based pricing more appealing, as customers can easily quantify savings and see a link between the service provided and its financial impact.

iDenfy, another player in the fraud management space, offers KYC (Know Your Customer) verification services with a similar outcome-based pricing model. It helps businesses verify customer identities and prevent fraud, charging only for successfully approved users. Both Riskified and iDenfy showcase how fraud prevention and identity verification services are well suited for outcome-based pricing, as success is clearly defined and measurable, directly linking service to value.

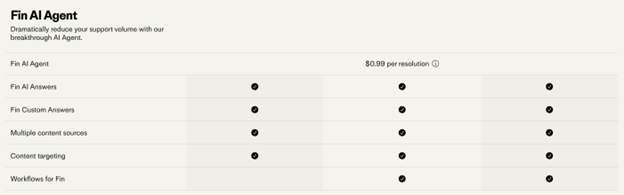

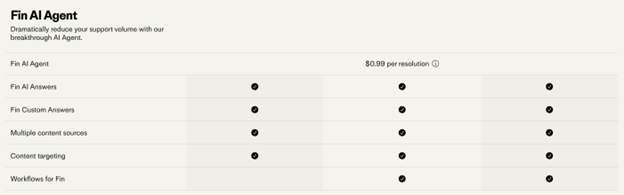

Shifting from fraud prevention to customer service, Intercom’s AI chatbot, Fin, offers another innovative example of outcome-based pricing. Launched in 2023 and closely watched as an early AI-based implementation, Fin costs $0.99 per successful resolution. This model, where clients pay only for effective AI interactions, demonstrates how companies can blend traditional usage-based and outcome-based pricing.

Intercom’s July 2024 pricing for its AI agent, Fin

Source: Intercom

As an early adopter in AI services, Intercom and its approach may accelerate a broader trend. AI’s ability to process vast data and deliver measurable results makes it particularly suited to outcome-based pricing, potentially reshaping pricing strategies across various SaaS sectors.

Outcome-based pricing opportunities

Outcome-based pricing ensures both parties are invested in achieving success, naturally building trust and loyalty. For instance, a marketing automation platform might charge based on lead quality or conversion rate, aligning its success with the client’s goals. As a result, providers may experience increased customer retention and acquisition of new customers, all while mitigating the risk of investing in services that provide little value. Additional benefits include:

- The potential to command higher prices for services that deliver value (a cloud storage provider could charge premium rates for guaranteed uptime and data security)

- The ability to differentiate from competitors in a crowded market (a project management tool might stand out by offering pricing tied to on-time project completion)

- Shared risks and rewards between provider and customer (a search engine optimization service could base its fees on improvements in search rankings or organic traffic growth)

- The encouragement of continuous improvement and innovation to achieve better outcomes (a customer service software provider might constantly refine its AI to improve resolution rates and maintain competitive pricing)

As the SaaS market evolves, outcome-based pricing offers a framework for aligning provider success with customer outcomes, potentially reshaping industry standards for value delivery.

Key considerations when considering outcome-based pricing

While outcome-based pricing offers many opportunities, it also presents some significant challenges. A key hurdle is measuring and attributing value in complex business environments. Consider a customer relationship management (CRM) program claiming to increase sales. If sales increase, to what extent can this growth be attributed to the CRM system as opposed to other factors such as market conditions, marketing efforts or enhanced sales strategies? This attribution challenge is complicated.

Another challenge is illustrated in our earlier job board example: Tracking job applications or clicks is simple, but measuring an applicant’s successful employment over an extended period is complex and resource intensive. Implementing sophisticated tracking and billing systems increases operational complexity.

Ensuring pricing fairness can present another obstacle. Buyers may be incentivized to underreport the value received to lower their costs. This creates a counterproductive scenario where customers argue against, rather than for, the value the software generates.

Other challenges include:

- Vendors must be prepared to absorb potential losses if outcomes are not achieved

- Certain industries may face regulatory and compliance restrictions on outcome-based models

These challenges underscore the importance of careful planning and robust systems when implementing outcome-based pricing. Vendors must weigh these potential hurdles against the benefits to determine whether this model is right for their business and their customers.

Implementing outcome-based pricing

Shifting to an outcome-based model requires careful consideration and preparation:

- Product/service adaptation: Ensure your offering can accommodate transparent measurement of agreed metrics

- Value measurement: Develop systems for accurate outcome measurement and price estimation

- Sales enablement: Align sales incentives with the new model, potentially basing them on planned annual contract value

- Billing and payment systems: Implement systems that can determine end-of-cycle billing based on outcomes delivered

- Customer engagement: Develop processes for ongoing interaction and collaboration with customers to drive outcomes and alignment

As companies navigate these implementation challenges, the landscape of outcome-based pricing is poised to evolve. Looking ahead, we can anticipate shifts in how this pricing model is applied and its broader implications for SaaS enterprises.

Future trends and implications

As technology advances, the ability to accurately measure and control outcomes will improve. This evolution will likely drive further adoption of outcome-based pricing models across various industries.

We may see increased use of “burstable reserve” models, combining predictable baseline pricing with outcome-based pricing for usage spikes. For example, a customer service AI platform might offer a fixed price for 1,000 monthly resolutions, then charge per successful resolution beyond that. This approach balances budget predictability with value-aligned pricing for additional usage.

As more companies adopt this model, we can expect to see innovations in contract structures, measurement technologies and risk-sharing mechanisms.

Charting the forward course

Deliberation of capabilities, market dynamics and customer needs is crucial before adopting this model. Providers should start by conducting thorough customer research to gauge the appetite for outcome-based pricing. Developing clear, measurable metrics that align with customer value is essential, as is investing in robust measurement and analytics capabilities.

Companies can begin with small-scale experiments, such as introducing outcome-based pricing for a single feature or a subset of customers. This approach allows for testing and refinement of systems while gathering valuable data, minimizing risk before broader implementation. Of course, this strategy may not be the right fit for every business, so careful contemplation is key.

Outcome-based pricing offers a compelling way to demonstrate value and build lasting client partnerships. L.E.K. Consulting has extensive experience advising SaaS businesses on innovative pricing strategies. To learn more about how we can help you optimize your pricing model and drive sustainable growth, please contact us.

L.E.K. Consulting is a registered trademark of L.E.K. Consulting LLC. All other products and brands mentioned in this document are properties of their respective owners. © 2024 L.E.K. Consulting LLC

Bibliography

Poyar, K. (2023). The State of Usage-Based Pricing. Growth Unhinged.

TrustRadius. (2023, December 15). iDenfy Review.