One CFO of a midsize company shared, “In my role, I oversee pricing for customer proposals and deals, and I sign all contracts. My responsibilities have extended well beyond traditional finance functions in both my current and former CFO roles.”

Business units in an organization are increasingly focused on financial metrics, such as tracking profitability, and are leveraging business intelligence (BI) solutions. These financial data-driven approaches enable organizations to make better-informed decisions, adapt quickly and drive innovation. Marketing teams are using financial tools to understand the return on investment, while human resources departments utilize data to analyze employee turnover costs and training program effectiveness. This broadening scope not only enhances operational control but also aligns financial strategies more closely with corporate objectives, demonstrating the CFO’s critical role in driving business success.

A finance leader in the telehealth sector noted, “As businesses grow and become more complex, the adoption of automation tools will inevitably increase. Companies may cut back on new tools, but they will not eliminate the key solutions that drive efficiency and help manage their operations’ increasing complexity.”

Achieving cost savings, efficiency and improved decision-making with third-party solutions

CFOs in this year’s survey cited three key reasons for adopting third-party solutions: cost savings, streamlined operations for greater efficiency and enhanced decision-making capabilities with access to more accurate and comprehensive data.

Priority: Cost savings

In the short term, third-party solutions enable CFOs to drive cost savings by improving decision-making capabilities. For example, the CFO of a midsize marketing agency faced challenges with data aggregation after several acquisitions. By adopting a third-party treasury solution, the organization made faster and more-informed decisions and improved operational efficiency.

The marketing agency CFO explained, “It is less expensive for the organization to operate this way. We became faster, more accurate — and the technology enables better decision-making.”

Another executive emphasized the importance of prioritizing profitable growth: “The market shifted, and we now need to prioritize profitable growth. I [send out a request for proposals] anytime we need to renew to reduce costs. These systems enable head count reduction, help reduce errors and enhance our credibility with the board.”

These examples illustrate how third-party solutions can help overcome data aggregation challenges and enable more-effective decision-making, ultimately leading to cost savings. By providing the necessary tools, visibility and control, these solutions empower CFOs to make informed decisions that drive efficiency and reduce operating expenses.

Priority: Streamlined operations for efficiency

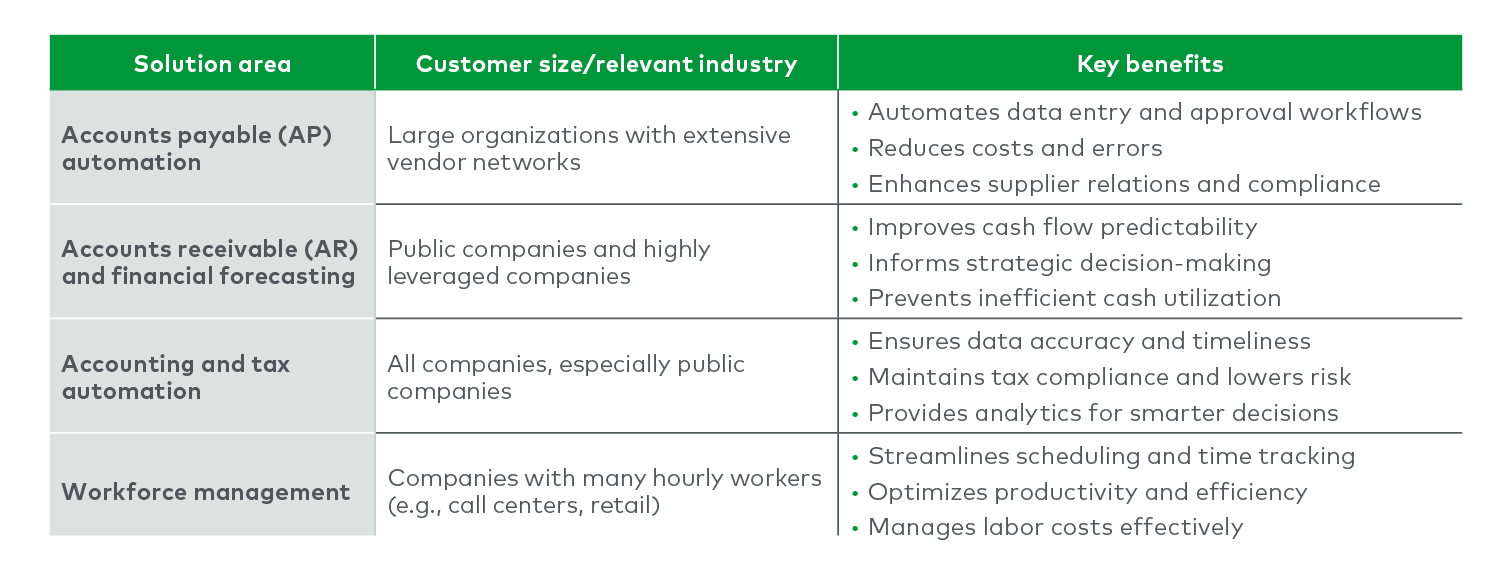

CFOs have identified digital strategy within finance and accounting capabilities as critical to their roles. Adopting the right tools is essential for boosting efficiency, reducing costs and achieving financial success. The 2024 survey reveals that most CFOs consider technology integration within their departments a top priority (see Figure 2).